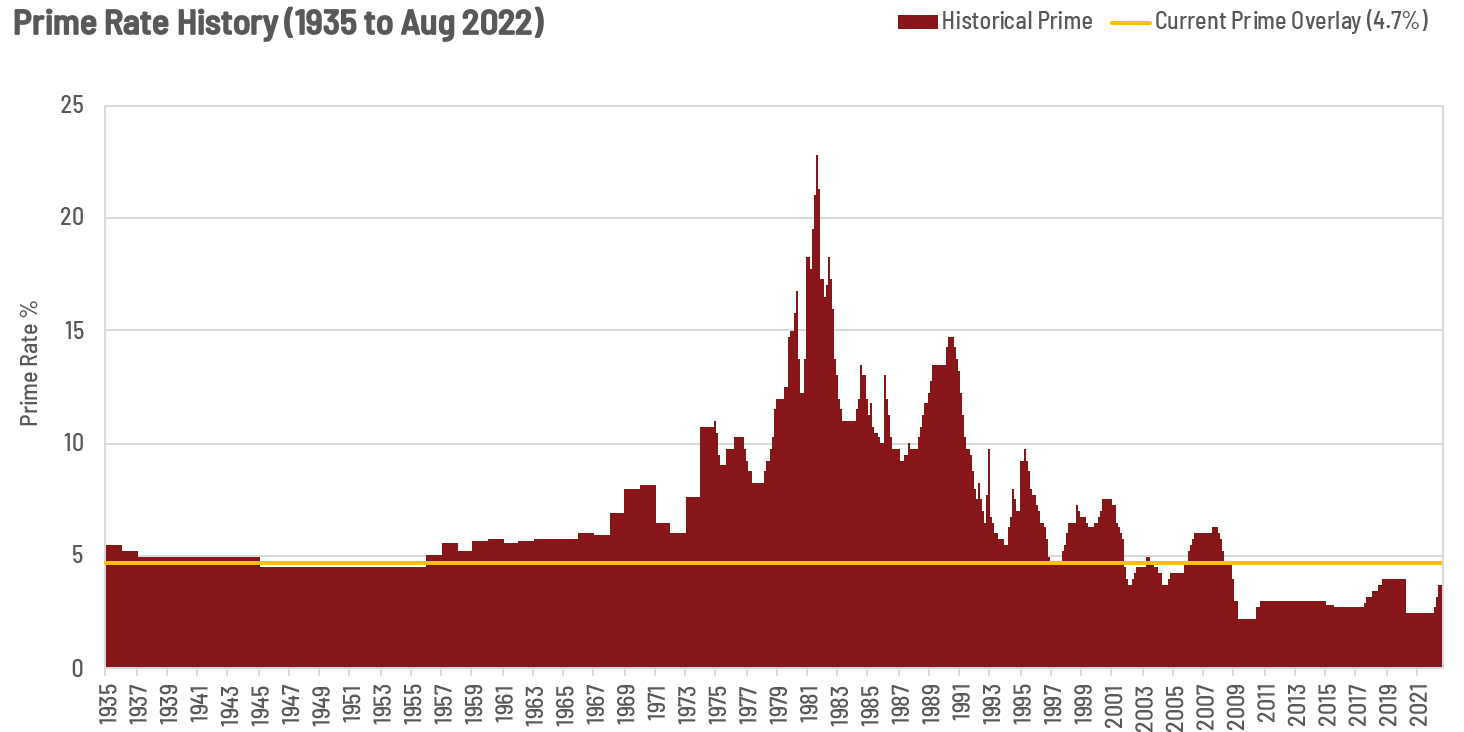

So for everyone freaking out about rates… I am sure you’ve seen things like “for every $100,000 your monthly mortgage payment goes up by $X” so I won’t repeat the same thing. Instead, here are a couple charts I put together on historical prime rates to bring some perspective to the matter.

First is the chart the media will probably like the best since it looks scary. If we just look at prime rate since 2009 (when rates hit new lows following the 2008 financial crisis), it seems we are at record highs (we aren’t even close).

Second is a longer term chart of the last 80+ years and you can see prime has usually been at 5%+.

As an investor it is important to put things in perspective. Turn off the TV and focus on the opportunity this will create.

1) Prices will continue to soften in the short term

2) You can still line up capital by adding a secured line of credit on your home if you haven’t already done so (at near peak values)

3) You can actually get a conditional offer accepted again (remember those?!?)

4) You will be able to buy hard assets (real estate properties) that hedge against 40 year record high inflation WITHOUT competing against 27 irrational people making emotional offers (and then knowing you overpaid if you actually succeed against that many crazy frustrated buyers)

The sky is not falling. Real estate is never going to $0. Take a deep breath and look for the opportunity.

The last decade has seen historically low interest rates and we have grown accustom to cheap money. Since early 2020 when central banks slashed overnight rates to near zero we have seen borrowing at near all time lows for an extended period. After a couple years this starts to feel normal, but it’s not. Over the longer term a more normal prime rate has been 5%+ and we aren’t even back to that level yet (as of July 13, 2022). In the next few months you’ll see prime increase by another 1-2% depending what happens with inflation and economic output.

So what does all this mean for investors and strategies? Well, a couple things are going to be tough:

1) Flips are not going to be easy in the coming months but can still work for smart investors who buy off market properties from motivated vendors and even then having a 2nd exit strategy or plan B would be smart.

2) Turn key rentals probably aren’t going to cash flow very well (they stopped making sense a while ago actually). But, smart investors will still find the opportunities.

On the flip side, here are a couple things I have seen smart investors doing:

1) BRRRs that add value to properties with a 5yr+ exit (no more easy recycling of your down payment, sorry)

2) Converting to highest and best use – I see some smart investors taking office space which is abundant (because working from home is here to stay) and converting it to residential (because we have a long term housing supply issue)

3) Short term rentals – more hands on but better cash flow and no need to deal with the Landlord Tenant Board (which is a disaster these days and a subject for another rant) … but be careful with your financing as lenders hate STRs.

Buffet says be fearful when others are greedy, and greedy when others are fearful. So, get greedy (or at least ready to be greedy) because people are scared right now. Get your capital lined up, and look for smart opportunities to make money that will be popping up right, left and centre as the market shifts.

If you need great advice on how to get your financing in order to take advantage of the market (or even just want to discuss the usual boring fixed/variable discussion), contact me and I’ll be happy to help.